how to calculate sales tax in oklahoma

Interactive Tax Map Unlimited Use. You will have to pay the same 325 sales tax on used vehicles however the first 1500 is taxed for 20 and the remainder is taxed at the 325 rate.

Amazon Collecting Oklahoma Sales Tax On Behalf Of 3rd Party Sellers Taxjar

When its time to report sales tax in Oklahoma you need to do three things.

. Sales tax rates in Oklahoma City Oklahoma. The state sales tax rate in Oklahoma is 450. However it must be noted that the first 1500 dollars spent on the vehicle would not be taxed in the usual way.

The Oklahoma State Sales Tax OK rate is currently 45. Oklahoma Sales Tax Calculator calculates the sales tax and final price for any Oklahoma. Oklahoma first passed a sales tax of at one percent in 1933.

Enter the Amount you want to enquire about. Oklahoma collects a 325 state sales tax rate on the purchase of all vehicles. 087 average effective rate.

This page covers the most important aspects of Oklahomas sales tax with respects to vehicle purchases. Oklahoma all you need is the simple calculator given above. The sales tax rate for the Sooner City is 45 however for most road vehicles there is a Motor Vehicles Excise Tax assessed at the time of sale or when the new Oklahoma car title is issued in the new owners name.

According to the Oklahoma Tax Commission homeowners pay a median property tax of just 1278 a year one of the lowest rates for any state in the country. Depending on local municipalities the total tax rate can be as high as 115. At a total sales tax rate of 825 the total cost is 37888 2888 sales tax.

Depending on the local municipalities the total tax rate can be up to 115. As a business owner selling taxable goods or services you act as an agent of the state of Oklahoma by collecting tax from purchasers and passing it along to the appropriate tax authority. You have three options to file and pay your sales tax in Oklahoma.

Counties and cities in Oklahoma are allowed to charge an additional local sales tax on top of the Oklahoma state sales tax. The Oklahoma state sales tax rate is 45 and the average OK sales tax after local surtaxes is 877. Sales Tax 50000 - 5000 - 1000 0325 Sales Tax 1430.

Oklahoma has a 45 statewide sales tax rate but also has 470 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 4242 on top of the state tax. The Oklahoma local sales tax is generally between 3 and 4 based on the municipality. Alone that would be the 14th-lowest rate in the country.

To know what the current sales tax rate applies in your state ie. Oklahoma sales tax details. Oklahoma currently charges a sales tax rate of 4 percent.

31 rows The state sales tax rate in Oklahoma is 4500. Use the sales tax formula below or the handy calculator at the top of the page to get the tax detail you need. Youll need to collect sales tax in Oklahoma if you have a link there.

Most vehicles all terrain vehicles boats or outboard motors are assessed excise tax on the basis of. If you are based in Oklahoma and selling to a buyer with a ship to address in Oklahoma charge sales tax based on the sales tax rate at the ship to address. Do I Have to Pay Sales Tax on a Used Car.

Currently combined sales tax rates in Oklahoma range from 45 percent to 115 percent depending on the location of the sale. Since 1990 when 05 percent was added for education reform under HB 1017 the states tax is at the rate of 45 cents for each dollar spent on taxable goods and services 45 percent. Until 1987 a portion of the sales tax was earmarked for the Department of Human Service.

Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Oklahoma local counties cities and special taxation districts. Usually the vendor collects the sales tax from the consumer as the consumer makes a. Calculate Sales Tax in Oklahoma Example Used Car Initial Car Price.

Simply enter the costprice and the sales tax percentage and the OK sales tax calculator will calculate the tax and the final price. Select the Oklahoma city from the list of popular cities below to. This means that depending on your location within Oklahoma the total tax you pay can be significantly higher than the 45 state sales tax.

Oklahoma are not assessed Oklahoma excise tax provided they title and register in their state of residence. Oklahoma Sales Tax. The excise tax for new cars is 325 and for used cars the tax is 2000 for the first 150000 and 325 on the remainder of the sale price.

Use our OkCARS - Sales and Excise Tax Estimator to help determine how much sales and excise tax you will pay on your new purchase. If you are not based in Oklahoma but have sales tax nexus in Oklahoma you are considered an Oklahoma remote seller. 325 of ½ the actual purchase pricecurrent value.

A customer living in Edmond Oklahoma finds Steves eBay page and purchases a 350 pair of headphones. With local taxes the total sales tax rate is between 4500 and 11500. The Oklahoma state sales tax rate is 45.

For vehicles that are being rented or leased see see taxation of leases and rentals. Oklahoma City sales tax rate in 2022 will be 8 per 100 million dollars of sales. Oklahoma has recent rate changes Thu Jul 01 2021.

Ad Lookup Sales Tax Rates For Free. Other local-level tax rates in the state of Oklahoma are quite complex compared against local-level tax rates in other states. When calculating the sales tax for this purchase Steve applies the 45 state tax rate for Oklahoma plus 375 for Edmonds city tax rate.

To file sales tax in Oklahoma you must begin by reporting gross sales for the reporting period and calculate the total amount of sales tax due. Taxes In Oklahoma Property taxes are fairly low as the state taxes itself at only 004 per year on average. The Oklahoma OK state sales tax rate is currently 45.

Thats where you need a Sales Tax Calculator like ours which will keep you at ease fully satisfied. What Is Okc Sales Tax. However in addition to that rate Oklahoma has the fifth-highest local sales taxes in the country tied with Louisiana the combined city and county rates are as high as 7.

Choose the Sales Tax Rate from the drop-down list. Tax rates for states counties and cities are shown here. The OK sales tax calculator has the option to include tax in the gross price as well as the amount to be added to net price.

Sales tax total amount of sale x sales tax rate Wise is the cheaper faster way to send money abroad.

Oklahoma Sales Tax Small Business Guide Truic

Understanding California S Sales Tax

How To Calculate Sales Tax For Your Online Store

Car Tax By State Usa Manual Car Sales Tax Calculator

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

Amazon Sales Tax What It Is How To Calculate Tax For Fba Sellers

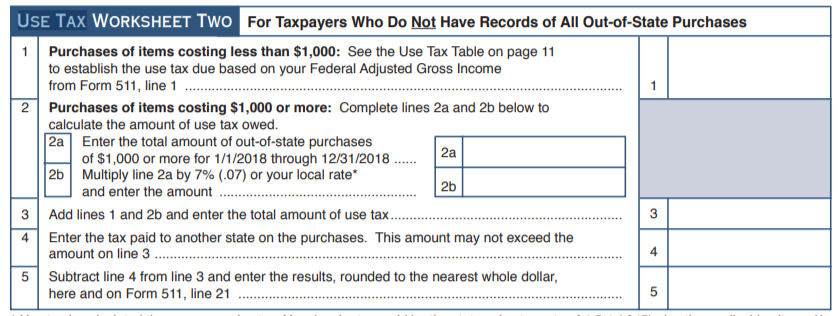

Do I Owe Oklahoma Use Tax Support

State And Local Sales Taxes In 2012 Tax Foundation

Oklahoma Vehicle Sales Tax Fees Find The Best Car Price

Sales Tax By State Is Saas Taxable Taxjar

Sales Tax The Complete Guide To Sales Tax In The United States Taxjar

Online Sales Tax Compliance Ecommerce Guide For 2022

How To Charge Your Customers The Correct Sales Tax Rates

How To Charge Your Customers The Correct Sales Tax Rates

Business Guide To Sales Tax In Oklahoma

Sales And Use Tax Rate Locator